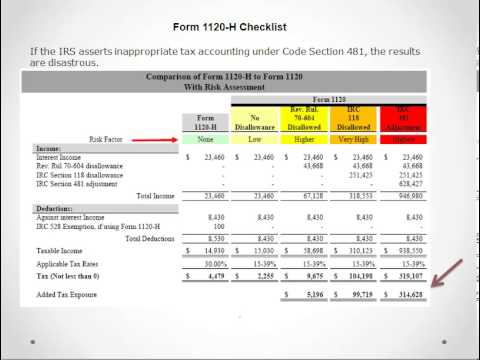

We're gonna take a slightly different look at the comparison between Form 1120 H and 1120 that is normally presented. The normal presentation does this one right here, which shows that hey, you pay $4,000 in tax on Form 1120 H, you only paid $2,000 in tax on Form 1120. That's the difference between a 30 percent tax rate and a 15 percent tax rate. Smart move, right? Well, not necessarily, not if you've got any problems in what you've done, and all these problems occur long before you ever file a tax return. The most common accusation by the IRS is that you didn't follow the proper procedures for making an election under Revenue Ruling 70-604, and they're gonna disallow that election. And all of a sudden, all that income you thought you were gonna roll over to the next year gets taxed this year, and instead of a tax savings of $2,000, you can have an extra tax bill of over $5,000. And it's too late to file Form 1120 H, you're already stuck. You're gonna pay some extra tax, but what if it gets worse? What if the IRS says, you know what, you didn't follow the six steps that are required under code section 118 for qualifying your reserve assessments as capital assessments, and therefore we're going to drag them in as current your income, and all of a sudden you're gonna pay an extra $99,000 of taxes. But if the IRS has done that, it's a certainty that they are going to then assert the inappropriate tax accounting under Code section 481. And then you've got some disastrous results because now your attempt to save $2,000 has just cost you $314,000 of additional taxes. How can that be? Code Section 481 is a tool whereby...

Award-winning PDF software

1120-f due date 2025 Form: What You Should Know

As far as I know, Form 8300 is only used with corporations and not a real individual. Form 941, U.S. Income Tax Return of a Foreign — IRS Form 1120-F — Expats with Foreign Corporations Trading in Mar 22, 2025 — The due date for filing Form 1120-F depends on whether the corporation has premises in the U.S. A foreign corporation filing this form must file Form 1120-F by July 13, or it will be late or have a penalty of 200. Form 940, U.S. Income Tax Return of an American Living Abroad — If the person is filing Form 941, they must file it by April 15. In contrast, Form 1120-F Filing a Foreign Income Tax Return on behalf of a U.S. Person Living Abroad Mar 22, 2025 — You can get a Form 941 from the US Treasury Department to file a tax return on behalf of U.S. citizen living abroad. However, you must file Form 1120-F with the Treasury Department before July 20, 2014. Form 1120 — Expats with Foreign Corporations Trading in Mar 21, 2025 — If the corporation has premises in the US, the deadline for filing Form 1120 is May 15. If the corporation does not have property located in California that it would be interested in selling, it will probably need to file Form 8300. As far as I know, Form 8300 is only used with trusts. Form 5320 — US Income Tax Withholding & Estimated Tax Form 1120 — Expats with Foreign Corporations Trading in Mar 22, 2025 — The due date for filing Form 1120 is April 15 for a corporation with premises in the US. When Does It Need To Be Filed? The due date for the form depends on what is being reported. When U.S. Person — Foreign Corporation — US Person is not US Resident (Form 1120-I), File Form 1531-A on the June 15th. When the IRS receives a Form 1120 in April for a U.S.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-F, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-F online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-F by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-F from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1120-f due date 2025