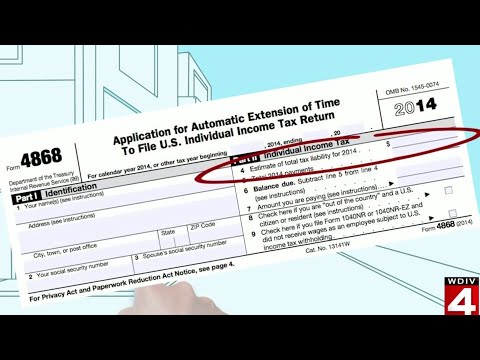

Good Monday morning. It is April 15th, which means it's tax day. For a lot of people, it's a moment of uncertainty - what am I going to do now? Well, if you haven't filed or even made plans to file, and you need to, here's what you can do: you can get an extension, pushing your filing date out to October 15th. Now, you're going to need to fill out a form 4868, which I have right here. On it, you'll have to put your properly estimated 2018 tax liability and write it on line four of your 4868. Get it in the mail before midnight tonight. Again, it's a small form, just a couple of lines, and that's all you need to do. The IRS will get in touch with you if your extension is not accepted; otherwise, you're in good shape. But here's the thing: if you owe the IRS money, you still have to pay all of it in full by midnight tonight, or you face penalties. So the IRS says, don't fill out the 4868 if you want the IRS to figure out your tax, or if you're under a court order to file your return by tonight. An extension is a good way out of this. We have all the forms linked on the Money Monday page, and you can click on detroit.com. Money Monday is brought to you by Northwood University.

Award-winning PDF software

1120-f due date 2025 Form: What You Should Know

S. Operations, the deadline is the 1st of the following month, i.e. the 1st of the month following the tax filing date. When Should You File? The due date for filing Form 1120 or Form 1120F is determined by the day the corporation files its tax return. It's best to check for an extension of time to file each time before April 15. Form 1120-G: Withholding Certificate | IRS Mar 1, 2025 — The deadline for filing Form 1120 is March 15. The due date is the 5th day of the 7th month of the year of the tax return you are filing. Form 1120-K: Foreign Return of a U.S. Corporation with Residence in the US | IRS May 5, 2025 — The deadline is April 15. The due date is May 31. Form 1125 — US Individual Income Tax Return for Tax Years 2025 through 2025 — Expat US Tax Mar 15, 2025 — Filing deadline: April 15th. Filing period: calendar year. If you filed your return on Form 3829, the due date for filing is March 31. Form 1125-K: Foreign Return of a U.S. Corporation with Residence in the US | IRS May 5, 2025 — Filing deadline: April 15th. Filing period: calendar year. If you filed your return on Form 3829, the due date for filing is March 31. The due date varies depending on the form. To find out from which the due date, check the following, Form 1120-F — Expats filing US Income Tax Returns Mar 17, 2025 — The due date for filing Form 1120 is March 31. The due date is the 5th of the 7th month of the year of the tax return you are filing. Check this page for the deadline for filing Form 8833 (Nonresident Alien) returns. If you are not filing a return for tax year 2025 (or tax year 2025 if you are not taxed in the US), the due date is April 15. Form 8833: Nonresident Alien Tax Return for Tax Year 2025 — Expat US Tax Mar 7, 2025 — The due date for filing Form 8833 is April 15 (if taxpayer is not required to file under section 6852 of the Internal Revenue Code).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-F, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-F online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-F by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-F from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1120-f due date 2025